Extrapolate that a little higher and we can still comprehend the numbers, but we start to lose that intuition. Are there 1,500 or 2,000 people at a music venue? It’s hard to know for sure, but we do at least have a basic comprehension of the sizes of those numbers. Every day, we do math with numbers in the thousands – a paycheck, a credit card bill, or paying rent.

Millions, billions, trillions

This is where things start to get dodgy. Once numbers get beyond the millions, we don’t really have any intuition, tactile familiarity, or comprehension of what they mean. For example:

One million seconds = 12 days One billion seconds = 32 years One trillion seconds = 32,000 years

Going back in time a trillion seconds would place you well before written history, the building of the pyramids, and 10,000 years before the first cave wall paintings in France. Our monkey brains don’t really know what to do with these giant abstractions, and so it helps to think about them in different ways, especially visually.

The Visual Interpretation

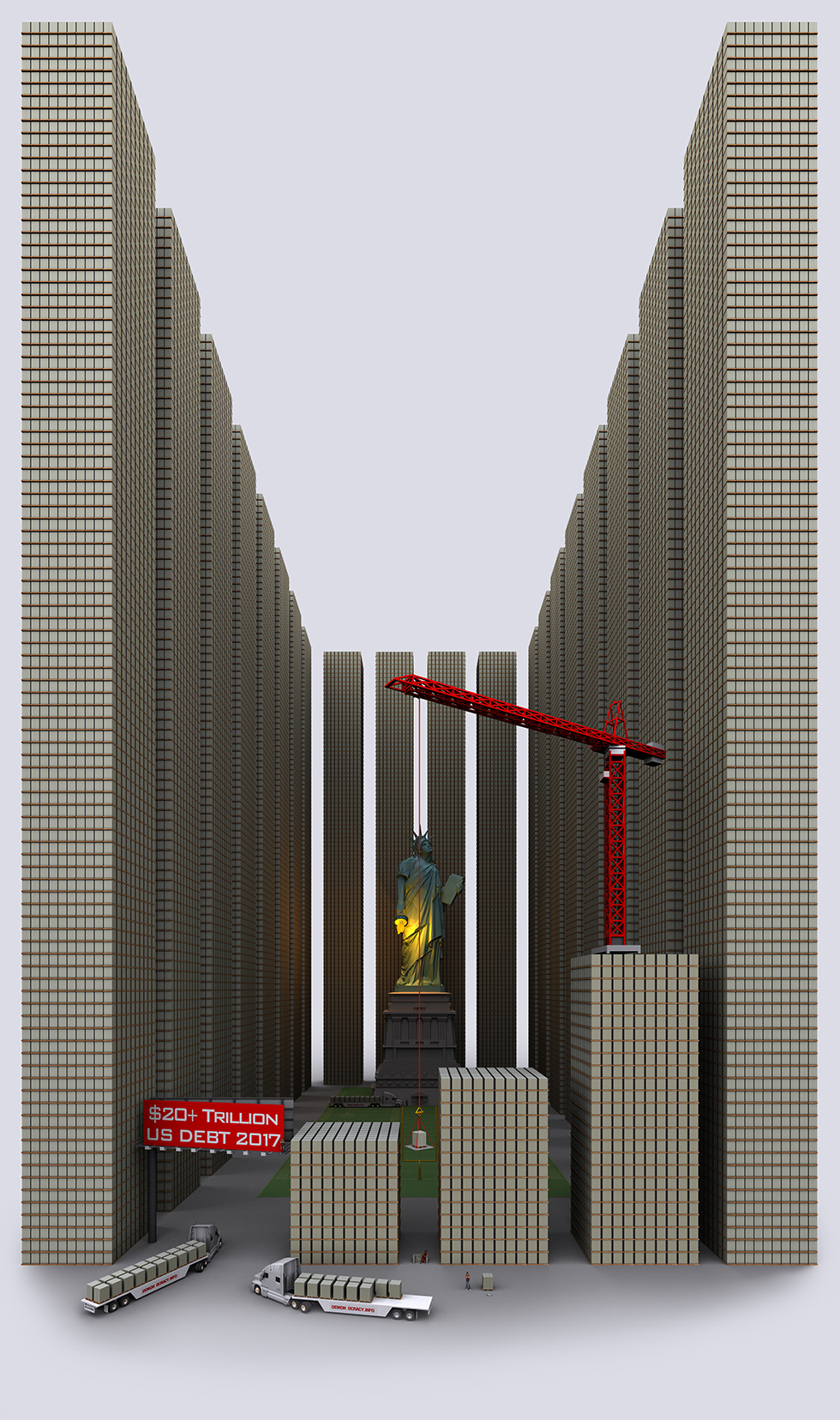

Looking at visual representations of these numbers will help to put them in perspective. Below is a series of fantastic 3d graphics produced by Demonocracy.info that help to do this for the $20 trillion in U.S. Federal Government debt. It starts with a $100 bill, and goes from there. Enjoy!

1. Here is a single $100 bill.

2. Here is $10,000, or 100 of those same bills in a stack.

3. $1 million, or equal to 92 years of work for the average human on Earth.

4. $100 million on a pallet. The couch is worth a cool $46.7 million, too.

5. $1 Billion – getting bigger…

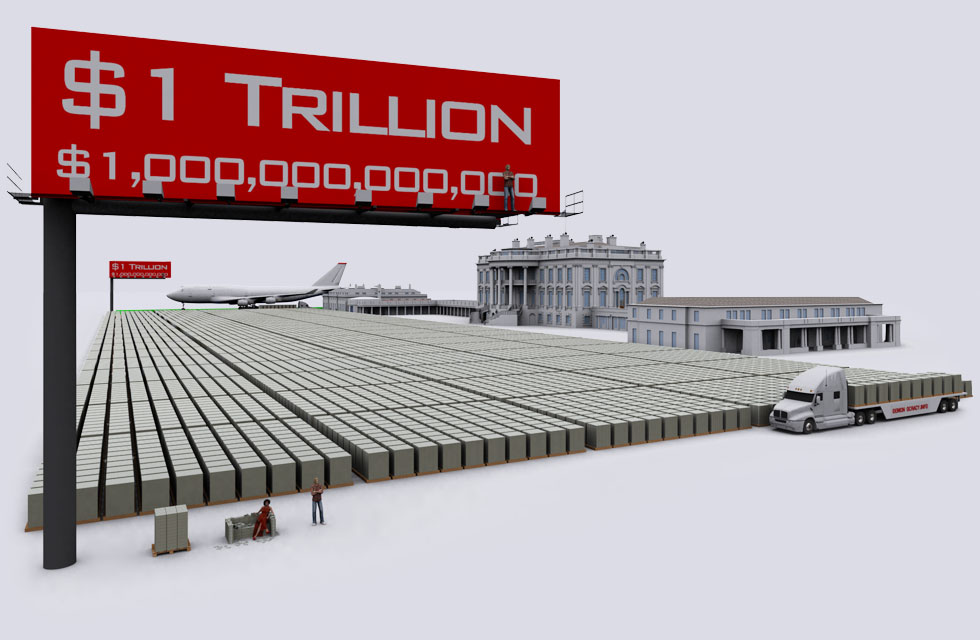

6. $1 trillion, looking at it from a front angle.

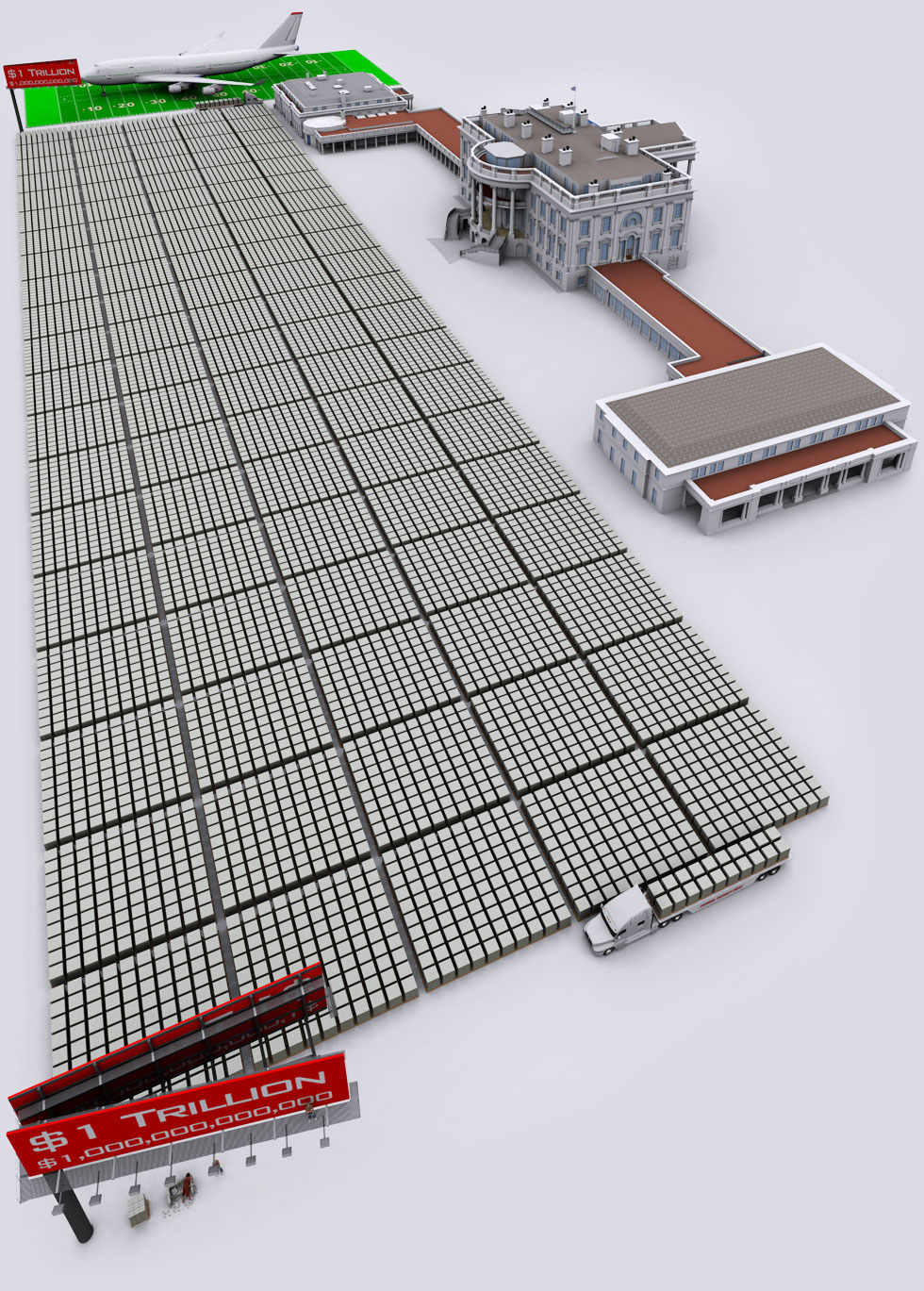

7. Here’s a better view of the $1 trillion with the White House.

8. Finally, here’s $20+ trillion of U.S. government debt.

For more on putting the U.S. debt in perspective, here’s a video showing Trump’s $20 trillion problem, as well as visualizing the debt from a more 2d perspective. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.